T02-0014 - Accelerate 2006 Income Tax Rate Cuts: Distribution of Income Tax Change by AGI Class, 2005 | Tax Policy Center

Greg Jericho on X: "Bizarre that negative gearing took off right after Howard and Costello changes the capital gains discount . Must have been one of those weird coincidences https://t.co/jqxPMOtq4F https://t.co/KLWICelr8k" /

Middle-aged death and taxes in the USA: Association of state tax burden and expenditures in 2005 with survival from 2006 to 2015 | PLOS ONE

T04-0090 - Supplement to Table T04-0082 Sub-Sample of Tax Filing Units with Positive Individual Income Tax Liability After Refundable Credits: H.R. 4359, Extension and Expansion of Child Tax Credit: Distribution of Individual

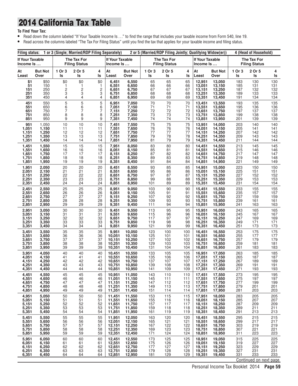

18 Printable 540 tax table Forms and Templates - Fillable Samples in PDF, Word to Download | pdfFiller

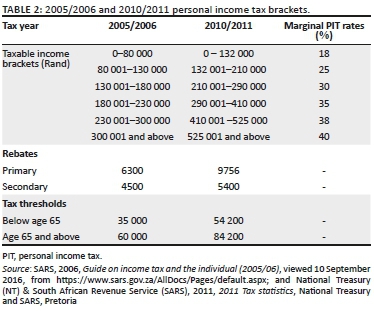

![PDF] The Macroeconomic Effects of Flat Taxation: Evidence from a Panel of Transition Economies1 | Semantic Scholar PDF] The Macroeconomic Effects of Flat Taxation: Evidence from a Panel of Transition Economies1 | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/1352db8abd6b7580b2ae7ff5258eb196e968c2a3/29-Table1-1.png)